The typical exits of the IPO or being bought by a public company are no longer in play. Where do you go from here?

How Our Client Rescued a Critical Integration and Avoided Millions in Penalties

A case study looking at one of our integration success stories.

What is Tech Diligence?

Tech Diligence is the concept of incorporating the tech ecosystem into your due diligence process. Why would you want to do that? Tech is, and will always be, a part of the integration process. Yet, there are two places where the tech side of the integration can make or break the merger, acquisition, divestiture activity: The first part goes against …

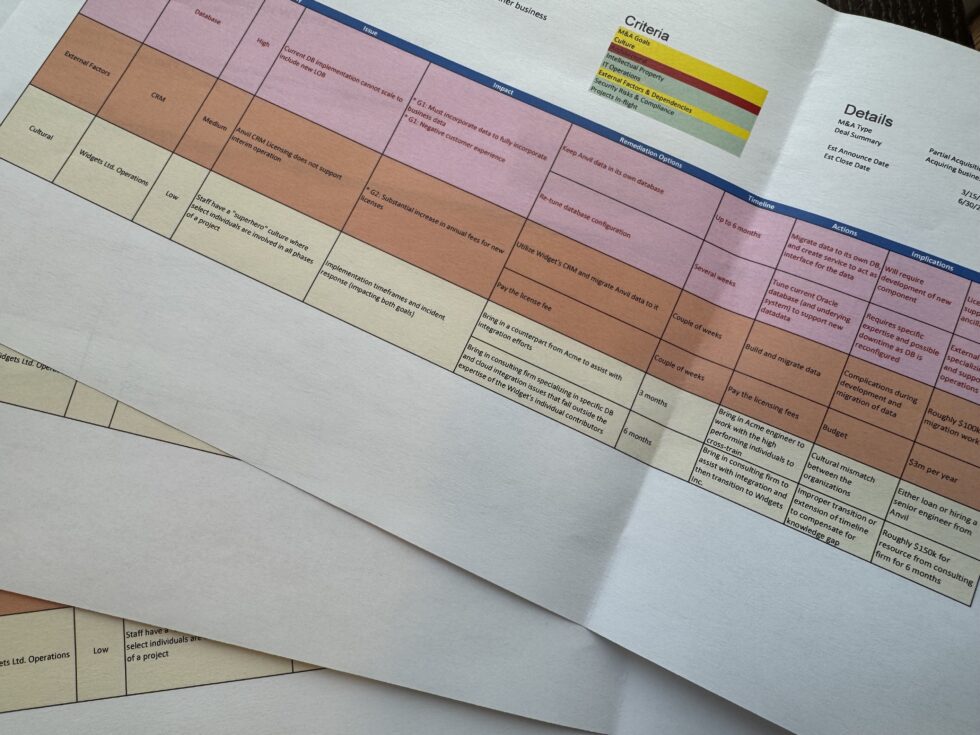

Tech Diligence Partial Acquisition Sample Readout

A sample readout based on this week’s tech diligence challenge.

Sample Crib Sheet #1

To provide a little more context on what I’ve been up to, I’ll be showing some samples of what these crib sheets look like and the story they tell. If you want to know more or provide feedback, then let me know. The Partial Acquisition The story for this involves the conglomerate Widgets Ltd. looking to buy the anvil subdivision …

Tech Diligence Crib Sheet

As a part of the Tech Diligence newsletter, I released a set of high-level questions that your team should ask that address two objectives: They are high-level specifically to find squishy answers and drill down on them. Ultimately, it is the combination that will give you, the final decision-maker, a clearer picture of what the level of effort will look …

Tech Diligence Checklist

Since starting the Tech Diligence list, I shared a couple of tools that I’ve used for helping my clients establish a baseline before they start looking at target companies and when they have a company in mind. Now I share the list with you in the hopes that it will help with your scoping efforts. If you find this helpful, …

What is your preferred medium for writing? BTW, I have something new to share.

Announcing a daily email list focused on the tech side of due-diligence

The Impact of Open Source on an Acquisition

Do you know what the impact open-source will have on the tech you’re just about to inherit? It is my belief, the changing market dynamics, more than anything else, poses the greatest threat to your tech stack post-acquisition.

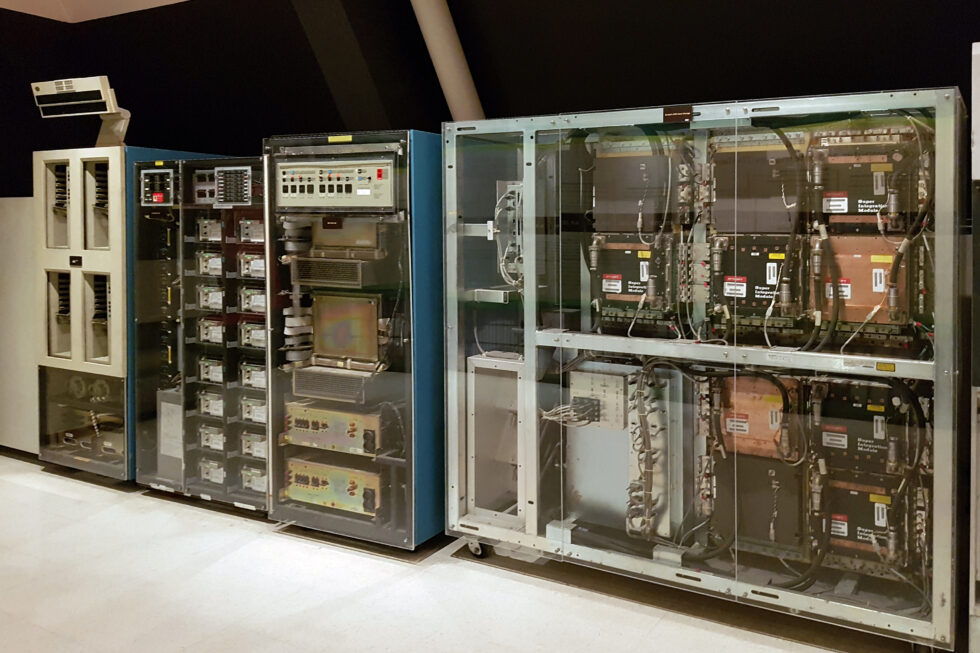

The Cost of Legacy on a Potential Aquisition

If you don’t think a company’s tech matters, think again. This is the single biggest risk and hidden cost when it comes to making your day one target and realizing the cost savings you were banking on with the acquisition.

- Page 1 of 2

- 1

- 2